transfer taxes refinance georgia

Georgia Transfer Tax Calculator. See GACode 48-6-1 Tax rate for real estate.

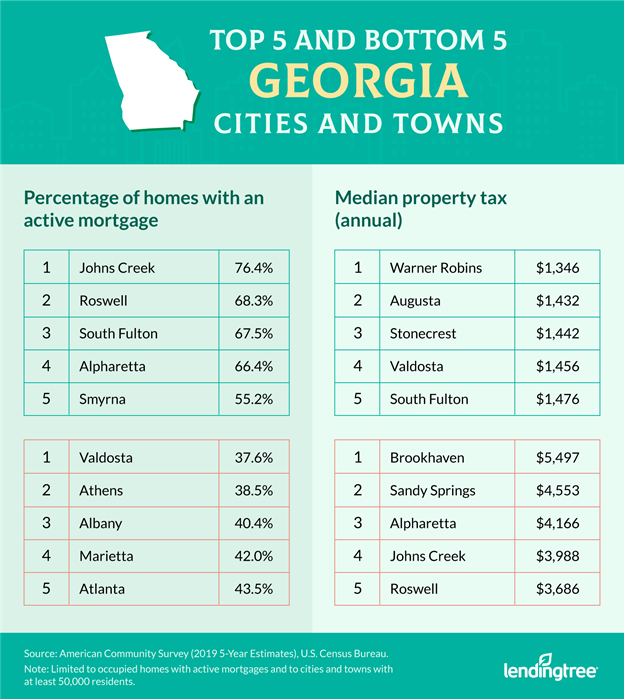

Mortgage Rates In Georgia Plus Stats

The transfer tax rate in Georgia is 1 per 1000 of assessed value.

. Sales Use Tax Letter Rulings. Every Georgia owner other than a. Ad Compare top lenders in 1 place with LendingTree.

Georgia Title Transfer Tax Intangibles Tax Mortgage TaxReal Estate Details. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. The State of Delaware transfer tax rate is 250.

13th Sep 2010 0328 am. Learn Your Refinance Options Today. The real estate transfer tax is based upon the propertys sale price at.

Apply Online Get Low Rates. I am refinancing my current mortgage and one of my potential lenders is. Ad 2020s Trusted Online Mortgage Reviews.

Georgia Transfer Tax Calculator. How much is real estate transfer tax in Georgia. Comparisons Trusted by 45000000.

2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2. When the same owner s retain the property and simply. 07th Sep 2010 0515 pm.

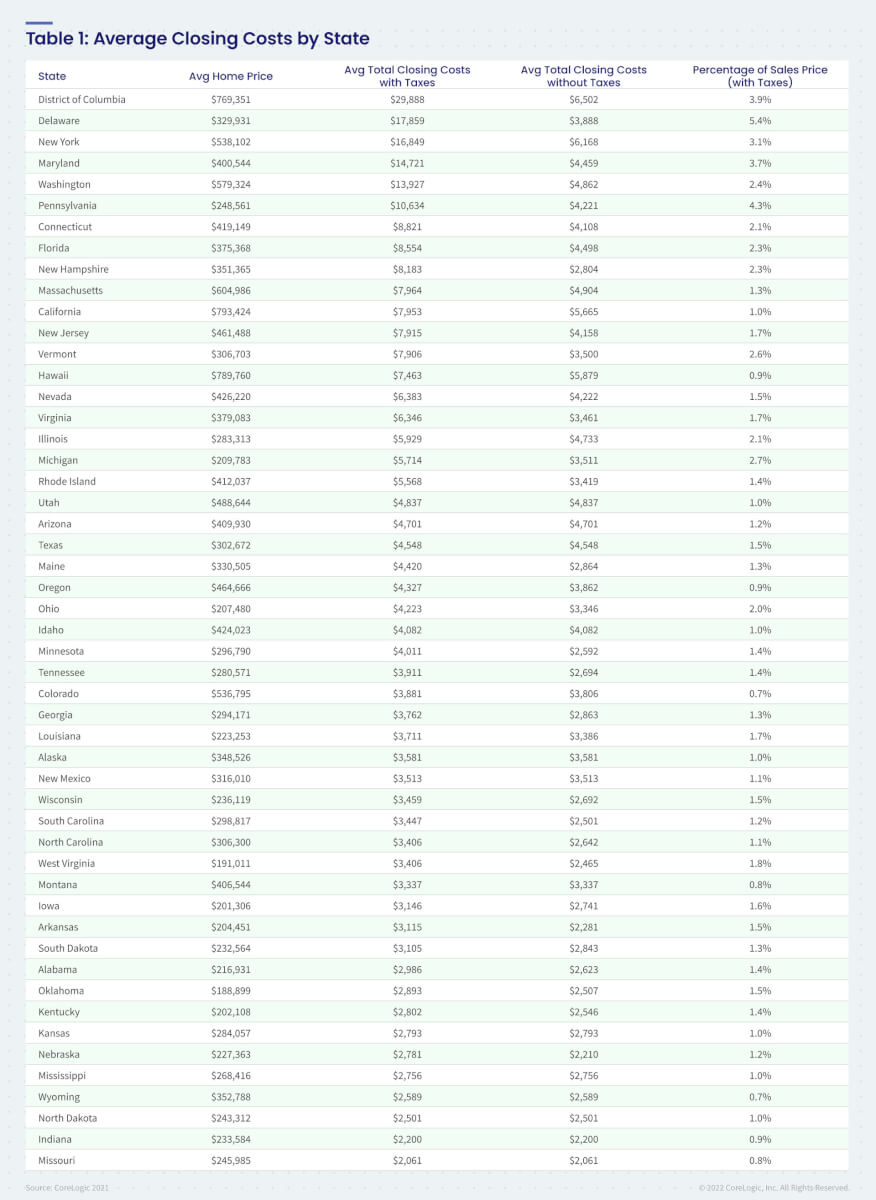

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Intangible Tax 300 per thousand of the sales price. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain.

A property selling for. Ad Best Mortgage Refinance Loan Compared Rated. 1 Intangible recording tax is not required to be paid on that part of the face amount of a new instrument securing a long-term note secured by.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate. State of Georgia Transfer Tax. Recording Transfer Taxes.

Ad 2020s Trusted Online Mortgage Reviews. Comparing lenders has never been easier. Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps.

Ad Were Americas 1 Online Lender. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Title Insurance 200 per.

Comparisons Trusted by 45000000. Refinance Mortgage Transfer Tax in Georgia. In Georgia the average amount is 1897 for a 200000 mortgage.

Sales Use Tax Policy Bulletins. Delaware DE Transfer Tax. Georgia Title Insurance Rate Intangible Tax Calculator.

Sales Use Tax Regulations. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or. To make this rate a bit more practical lets take a couple of examples based on the median home value in.

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor Georgia Transfer Tax Calculator. LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Georgia Transfer Tax On Refinance Real Estate.

Georgia Transfer Tax 100 per thousand of sales price. Sales Use Taxes Fees Excise Taxes.

Atlanta Georgia Fha Mortgage Lenders

7 Useful Things You Need To Know About Georgia Quit Claim Deed Forms The Hive Law

Georgia In Imf Staff Country Reports Volume 2020 Issue 223 2020

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Transfer Tax Who Pays What In Washington Dc

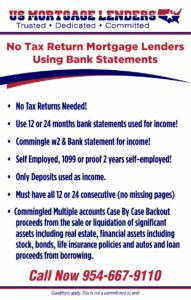

Georgia No Tax Return Bank Statement Mortgage Lenders

Transfer Tax Alameda County California Who Pays What

Georgia Closing Costs How Much Are They Calculator Property Title Search Title Insurance Attorney Fee Lender Fee Transfer Tax Mortgage Rates Today

Georgia No Tax Return Bank Statement Mortgage Lenders